GET YOUR HOME SOLD FASTER AND FOR TOP DOLLAR

or give us a call and ask for a Canzell Certified Agent

$500 Advanced Real Estate Course:

FREE for anyone who attended eXpCon. Code is: exp

HOW TO DOUBLE YOUR REAL ESTATE BUSINESS

Learn How Chantel Ray Scaled Her Business:

Closed 1500 Homes a year

______________________________________________

Dominated a Local Area

______________________________________________

Created Teams in Over 20 States

MARKETING

HEALTH

WEALTH BUILDING

REAL ESTATE

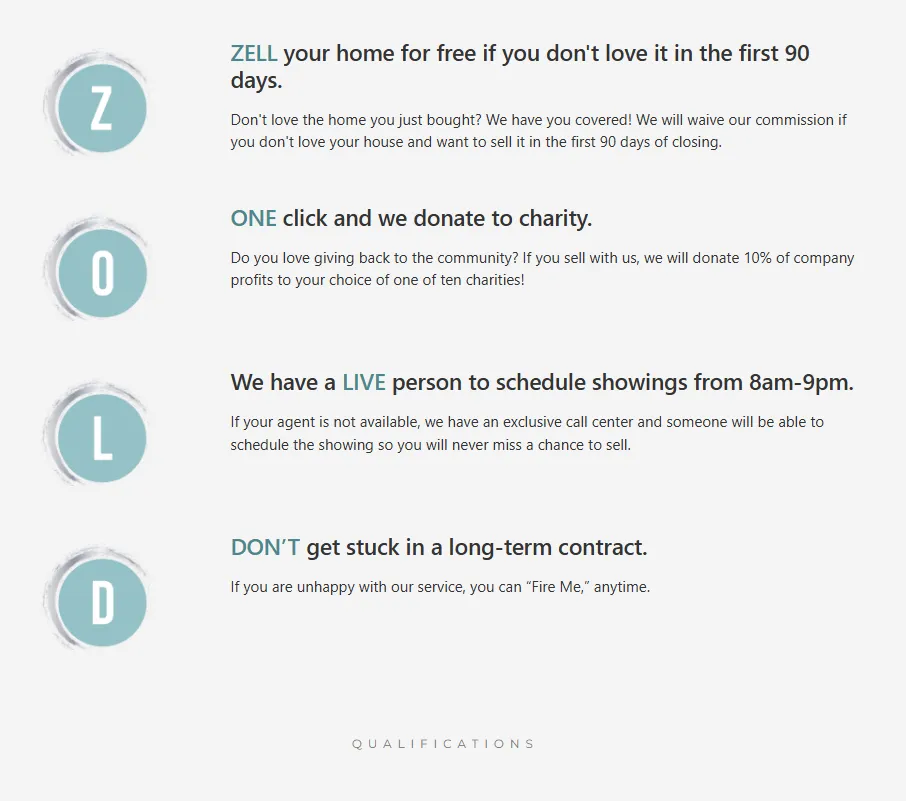

Chantel's Promise

My promise is to put our client’s interests above my own. I’ve created 3 pillars that define the core of this promise Health, Wealth, and Wisdom.

Gain access to Chantel Ray’s Buyer Guide for all the latest tips to follow when buying a new home.

Selling your home? Download our Seller’s Guide for insight on how to get the best value for your home.

Health, Wealth, and Wisdom

Well known for combining spirituality, faith, mindset , health, and godly wisdom

and actions to help people produce real changes in their lives. Discover how to achieve your full potential utilizing Chantel Ray’s 3 Pillars of Success.

Diet & Exercise

Chantel Ray Way Podcast

Wellness Books

Buy/Sell Real Estate

Become an Agent

Wealth Groups

Coaching

Speaking

Bible Studies

Non Toxic Family Podcast

Chantel Ray Way Podcast

Family Fasting

BUILD A LIFE THAT CREATES TIME FOR YOU AND YOUR FAMILY

How to LEAD, DELEGATE & Become a TIME Millionaire. Order your book today! Start your journey to becoming a time millionaire!

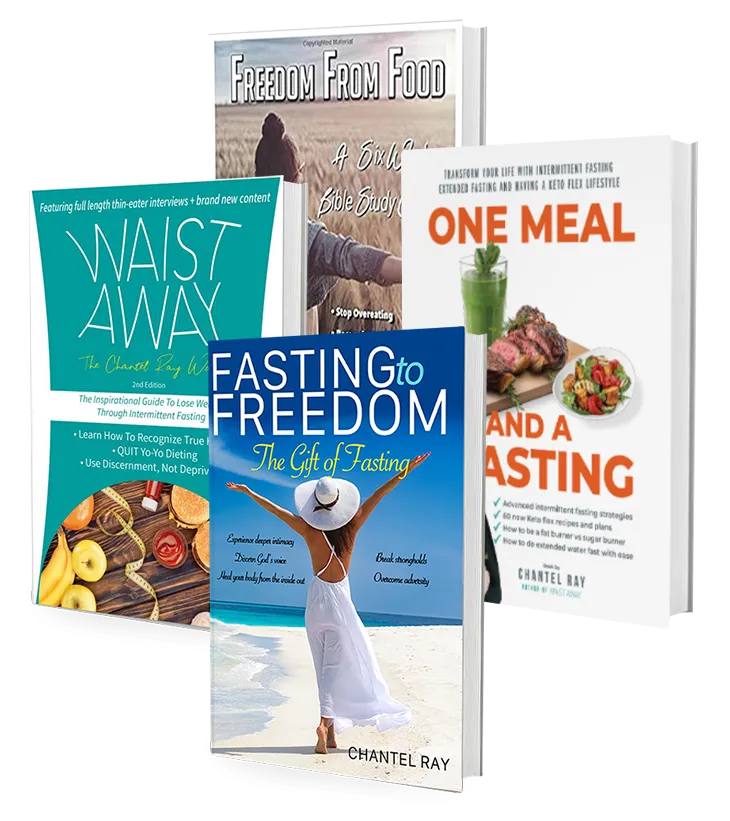

GET ALL 4 BOOKS IN

E-BOOK AND AUDIOBOOK IN ONE BUNDLE!

FOR ONLY $39.99

(Workbook is the only one not included in audiobook.)

A Note From Chantel Ray

“I’ve come to realize the importance of maintaining a balance between health, wealth, and wisdom. They each play a crucial role in our overall well-being, working towards fulfillment and growth.

Health reminds us to prioritize self-care, while wealth extends beyond material riches, through experiences and relationships. Wisdom, gained through life’s experiences, guides us to understanding.”

Discover Chantel's Personal Story

See what's trending on Chantel Ray's Instagram

@TheChantelRay

CHANTEL RAY WAY

PODCAST

Over 4 Million+ Views | 400+ Episodes

Best Selling Books

Written by Chantel Ray

Waist Away

The secrets in this book were first proven to be successful by Chantel Ray herself. She then shared her success with friends and family and became an instant hit. Now her secret is going viral.

One Meal & A Tasting

When you order Chantel ray’s new book “One Meal and a Tasting” on Amazon you will receive FREE entry into the next One Meal and a Tasting Masterclass Session.

Fasting to Freedom

Experience supernatural healing, overcome difficult times, receive provision and live in abundance, live under the shelter of God’s protection, and to finally break free from that sin that has you in a choke hold.

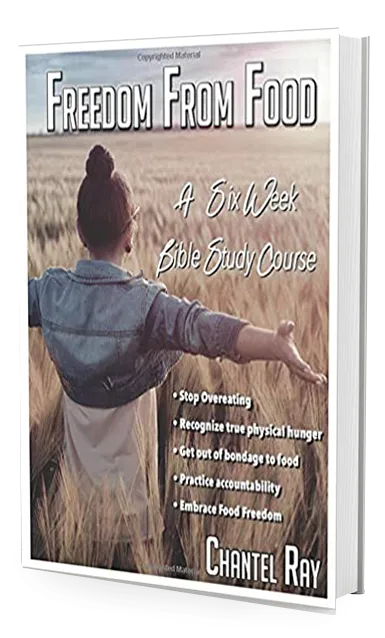

Freedom from Food

This 6 week Bible Study uses scripture to teach you to: overcome the temptation of food, avoid gluttony and overeating, understand when your body is truly physically hungry, develop a deeper more meaningful relationship with Christ.

VIDEOS

HEALTH

WEALTH

WISDOM

Contact Us

Real Estate Education

Our real estate firm has teamed up with Moseley Real Estate Schools! Moseley has been training students in the real estate industry since 1972 and offers real estate education for Salesperson Licensing, Broker Licensing, and Continuing Education, and Post License Education. Get your free, Virginia real estate education today!